- HOME

- IR information

- To individual investors

- What kind of company is MIRAIT ONE?

What kind of company is MIRAIT ONE?

This is an introduction of MIRAIT ONE.

Formation of the MIRAIT ONE Group

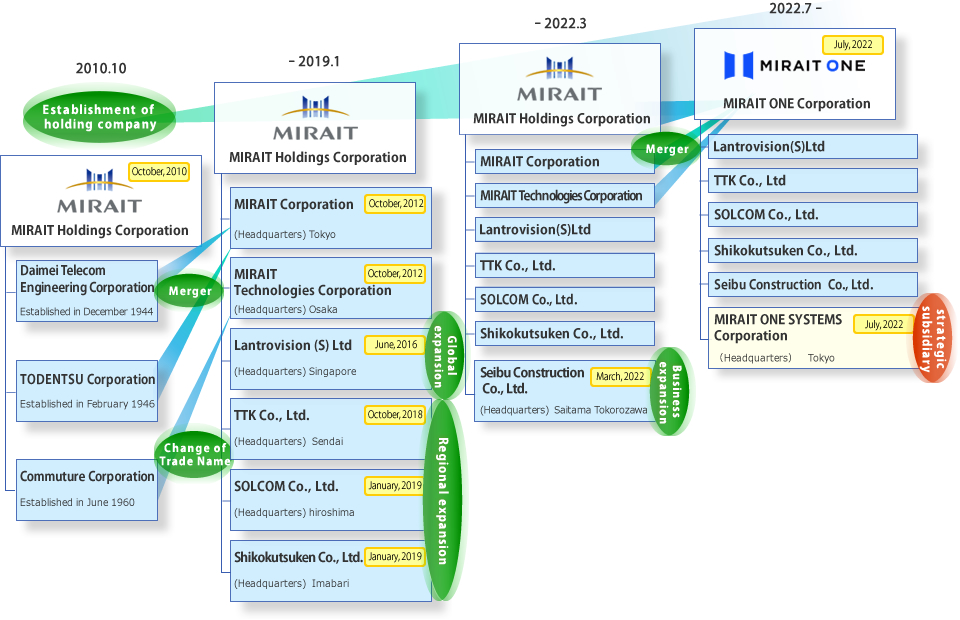

- Established in 10/2010 with the management integration of Daimei, Commuture and TODENTSU, each with a history of more than half a century centered on building communication infrastructure.

- Promoted the structural shift to become a ”Comprehensive Engineering and Services Company” through M&A and other efforts following the management integration.

- Three operating companies were reorganized into two entities (MIRAIT and MIRAIT Technologies) on October 1, 2012.

- Acquired Lantrovison(S)Ltd in Singapore in 6/2016 to expand global business.

- Management integration with TTK in 10/2018, and Solcom and Shikokutsuken in 1/2019, to further enhance the Group’s business base and corporate value.

- Made SEIBU CONSTRUCTION a Subsidiary in 3/2022

- The Company merged with its consolidated subsidiaries MIRAIT Corporation and MIRAIT Technologies Corporation on July 1, 2022 to become MIRAIT One Corporation. In addition, we have reorganized the SI business organizations of the group companies under our umbrella and the five SI business companies and established MIRAIT ONE SYSTEMS Corporation.

- Made Kokusai Kogyo a Subsidiary in 12/2023

To Business Growth

1. Focus of Business Growth

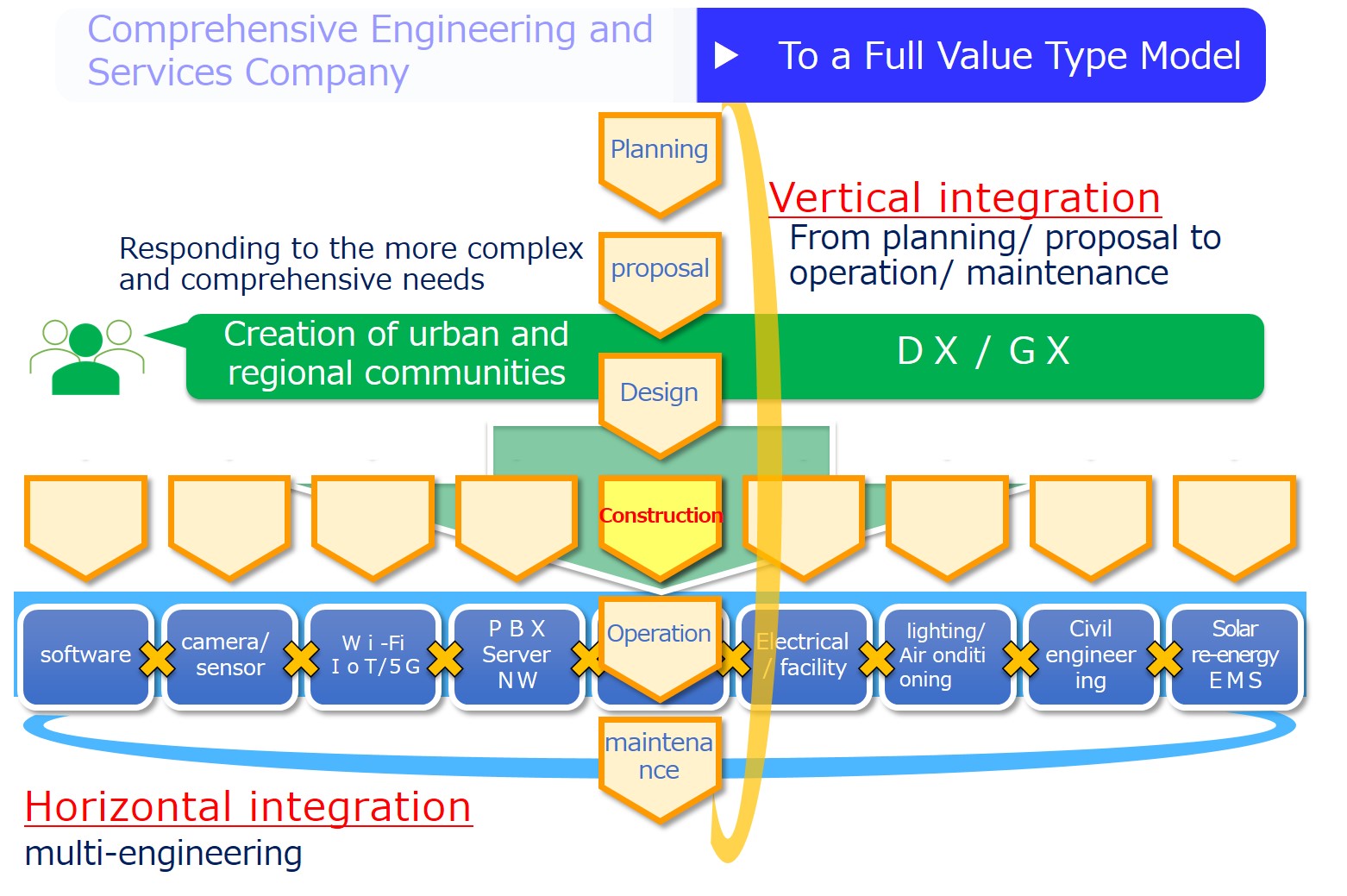

2. To a Full Value Type Model

Shareholder Returns

Shareholder Returns

| FYE March 2022 | FYE March 2023 | FYE March 2024 | FYE March 2025 | |

|---|---|---|---|---|

| Net income | 25.1 bil. yen | 14.7 bil. yen | 12.5 bil. yen | 17.2bil. yen |

| Annual dividends per share | 55 yen | 60 yen | 65 yen | 75 yen |

| Total dividends | 5.4 bil. yen | 5.8 bil. yen | 6.0 bil. yen | 6.8bil. yen |

| Consolidated dividend payout ratio | 21.9% | 39.7% | 48.7% | 39.6% |

| Issued number of shares (thousands) | 108,325 | 103,325 | 94,325 | 91,325 |

| Number of treasury shares (thousands) | 8,971 | 7,114 | 1,652 | 1,075 |

| Share repurchase | 5.0 bil. yen | 5.0 bil. yen | 7.0 bil. yen | 5.0 bil. yen |

| Consolidated total return ratio | 41.7% | 73.2% | 104.5% | 68.6% |

| ROE | 10.7% | 6.0% | 5.0% | 6.7% |

- (Note)

- Figures in ( ) for consolidated dividend payout ratio, consolidated total return ratio and ROE exclude the impact of negative goodwill from the recent acquisitions.

MIRAIT ONE Group Vision 2030 (Overview)

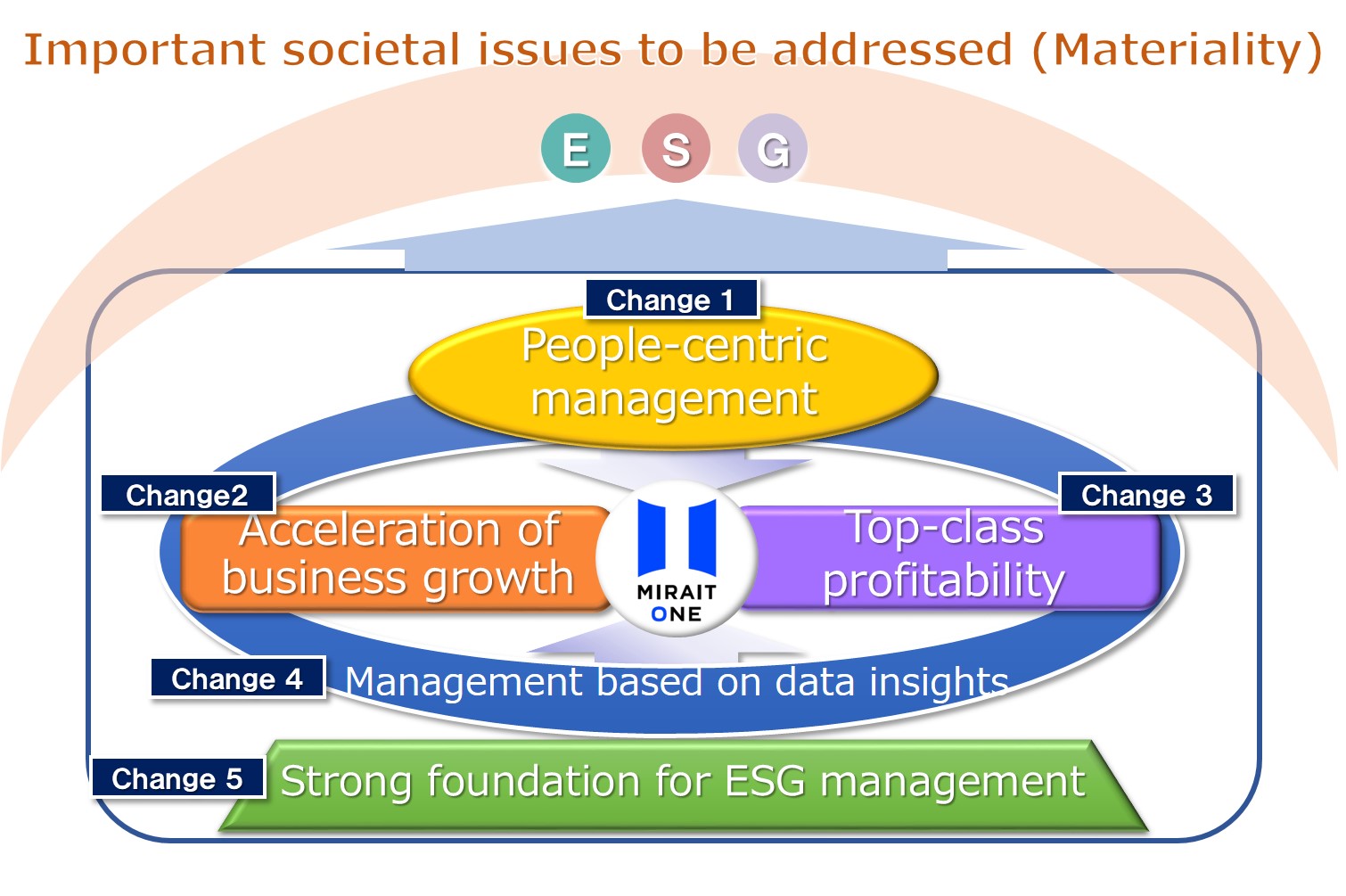

Business transformation and the “Five Changes”

- Change 1: People-centric management

- MIRAI College: “Driving force of business structure reform” providing learning and connection

- “Health management” creating a friendly working environment and protecting the physical and mental health of employees

- MIRAIT ONE work style reforms supporting work-life balance

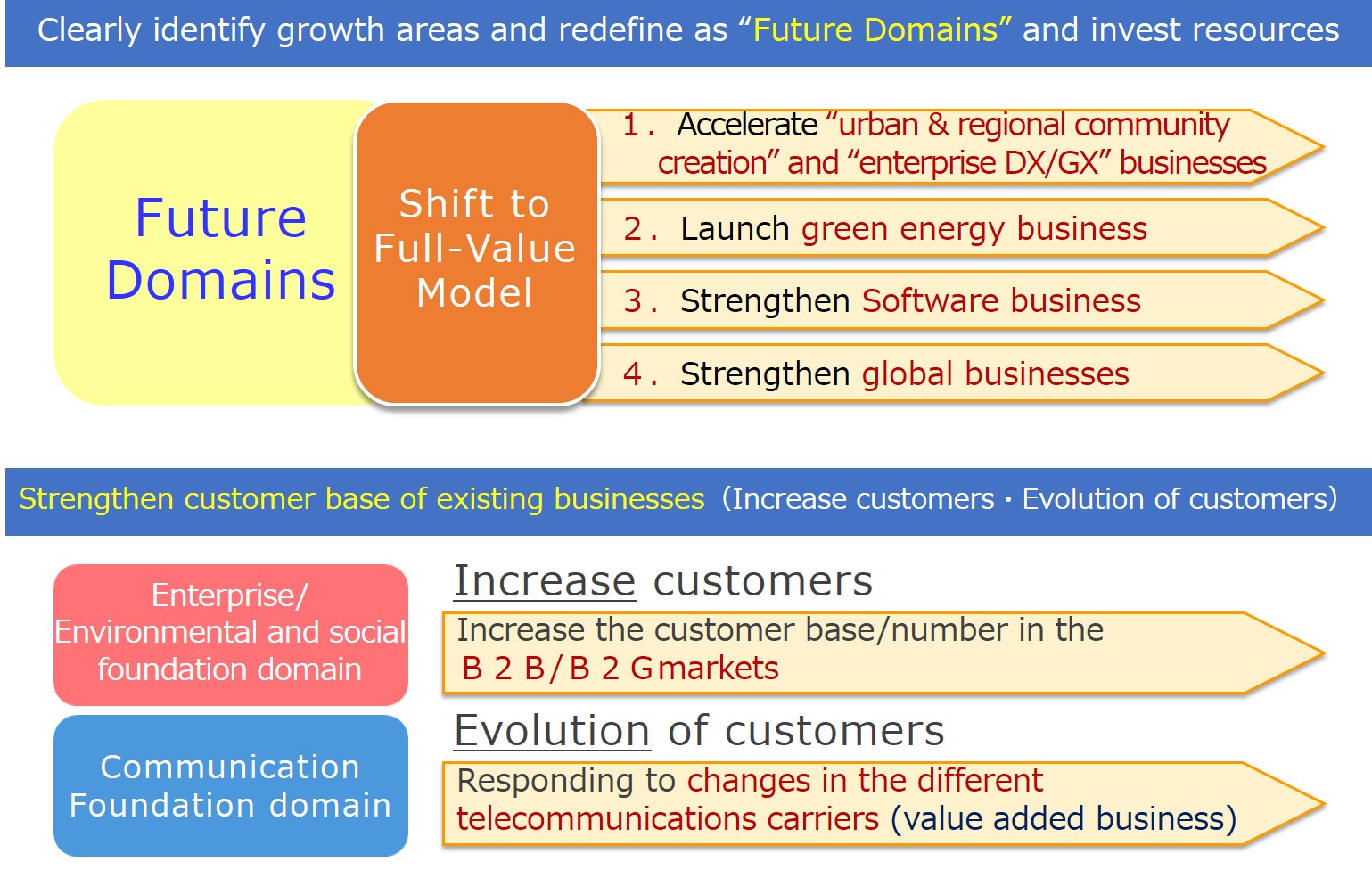

- Change 2: Acceleration of business growth

- Clearly redefining growth areas as “MIRAI Domains” and injecting resources (promotion of business structure reform to a full-value model)

- Urban development and regional development business, and acceleration of corporate DX and promotion of green operations

- Entry into the green energy business contributing to decarbonization (GX)

- Strengthening of SI business contributing to customers’ DX

- Strengthening of global business promoting overseas data center related business and infrastructure sharing

- Strengthening of customer base of existing business (responding to expansion of customers and growth of customers)

- Clearly redefining growth areas as “MIRAI Domains” and injecting resources (promotion of business structure reform to a full-value model)

- Change 3: Top-class profitability

- Strengthening of management foundation through concentration and improvement of efficiency by integrating the three companies

- Fundamental review and streamlining of business operations through the use of data insights and generative AI, etc.

- Review of existing operations and costs through promotion of group coordination

- Change 4: Management based on data insights

- Establishment of knowledge-based data environment and optimization of sales approach (aggressive DX)

- Value chain reform, smart construction, utilization of BPO/RPA/robotics (defensive DX)

- Development of experts and core personnel, improvement of companywide literacy (development of DX personnel)

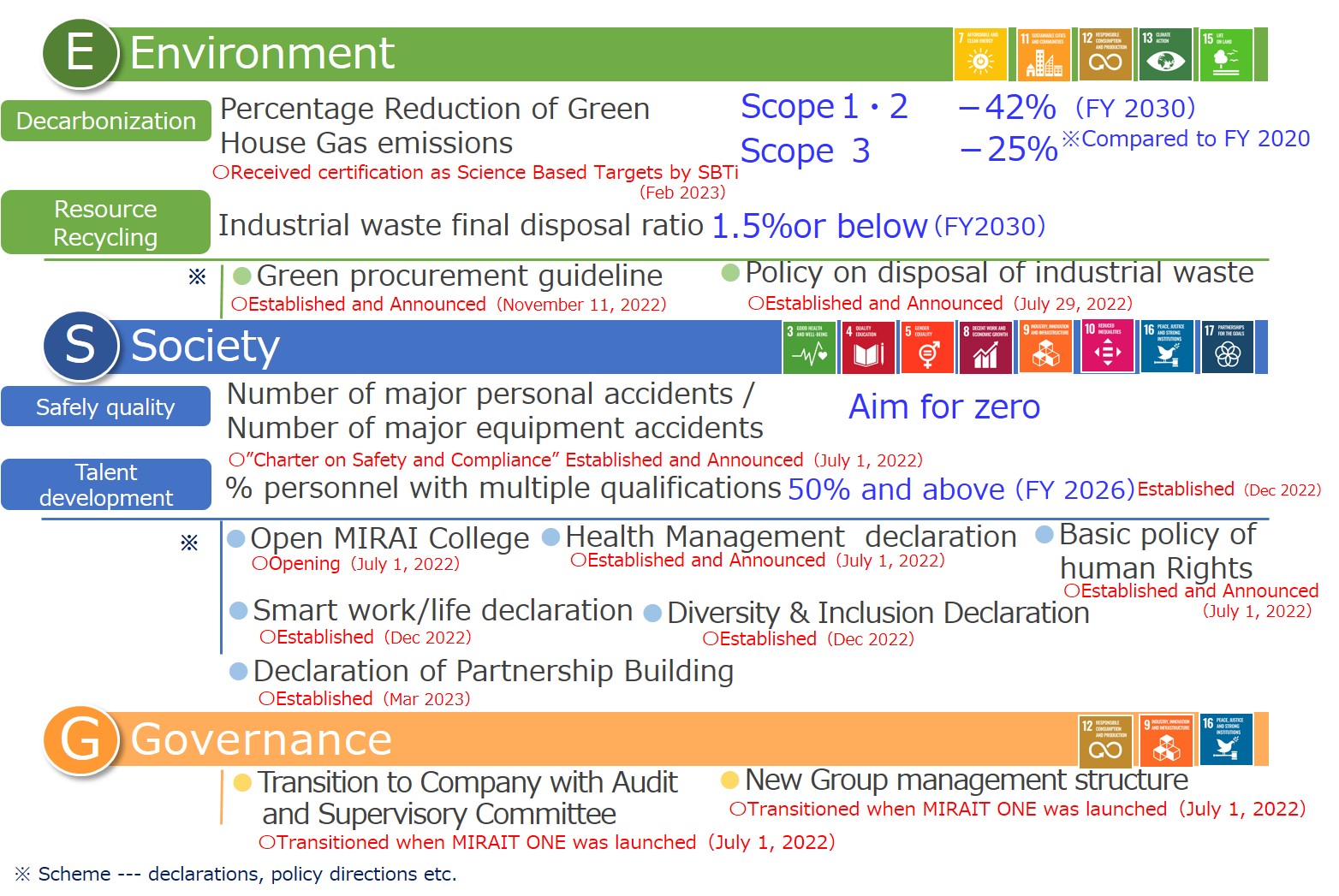

- Change 5: Strong foundation for ESG management

- Initiatives aimed at the achievement of greenhouse gas reduction targets (science-based targets)

- Creation of social value through the MIRAIT ONE Partner Association

- Enhancement of audit system and strengthening of audit functions through third line of defense

- Strengthening of corporate governance through new Group management system

Targets (FYE March 2026)

| Mid-term Target | Forecast | |

|---|---|---|

| Net sales | 720.0 bil. yen | 620.0bil. yen |

| MIRAI domains composition ratio ※ | 45%+ | 43% |

| EBITDA Margin | 8.5% | 7.7% |

| Operating income | - | 34.0 bil. yen |

| Operating income ratio | 6.5% or more | 5.5% |

| ROE | 10% or more | |

| EPS growth rate | 10% or more(per year) | |

| Shareholder return policy |

|

|

| Capital policy |

|

|

※Percentage of sales accounted for by MIRAI domains (areas targeting business growth)

Medium-term Management Plan (non Financial)